On July 19, Governor Cuomo announced final regulations implementing New York’s nation-leading Paid Family Leave (PFL) program. The state’s PFL program will provide New Yorkers with job-protected, paid leave to bond with a new child, care for a loved one with a serious health condition or to help relieve family pressures when someone is deployed abroad on active military service.

Insurance companies notified disability benefits (DB) policyholders that PFL will be added to their DB policies effective January 1, 2018. Nearly all employees of DB policyholders will be automatically covered for PFL.

PFL will be funded through employee payroll deductions. As an employer, you are responsible for collecting the appropriate PFL contributions to cover the cost of the program. You may begin employee payroll deductions for PFL as of July 1, 2017.

The rate of PFL is 0.126% of the employee’s weekly wage, not to exceed 0.126% of the current New York State average weekly wage (AWW) of $1,305.92.

Please review the fact sheet for further information.

On November 2nd, the African American Men of Westchester and the Business Council of Westchester will host its 28th Annual Brotherhood Breakfast. This will be an excellent opportunity to network with business leaders and government officials.

On November 2nd, the African American Men of Westchester and the Business Council of Westchester will host its 28th Annual Brotherhood Breakfast. This will be an excellent opportunity to network with business leaders and government officials.

Congratulations to BYB’s Wiley Harrison on his recent appointment to Westchester County Executive George Latimer’s MWBE Task Force.

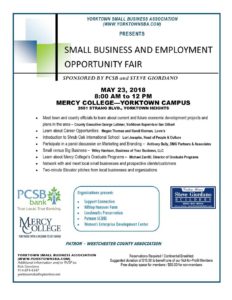

Congratulations to BYB’s Wiley Harrison on his recent appointment to Westchester County Executive George Latimer’s MWBE Task Force. Please join the Yorktown Small Business Association on May 23rd; Wiley Harrison will be a guest speaker at their Small Business and Employment Opportunity Fair discussing “Small Business vs Big Business.”

Please join the Yorktown Small Business Association on May 23rd; Wiley Harrison will be a guest speaker at their Small Business and Employment Opportunity Fair discussing “Small Business vs Big Business.”

From 12/31/2017 to 12/30/2018, the basic minimum wage is $10.40 per hour in most of New York State.

From 12/31/2017 to 12/30/2018, the basic minimum wage is $10.40 per hour in most of New York State.