Category: Tips for Small Business (page 1 of 4)

As of 1/1/2025, general minimum wage in New York State is as follows:

General Minimum Wage Rate Schedule

NYC – Large & Small Employers $16.50

Long Island & Westchester $16.50

Remainder of New York State $15.50

The minimum wage rate differs based on industry and region.

Click here for additional information for:

- tipped, fast food, and other workers

- free posters on the increased minimum wage specific to your industry

Employers must post a Minimum Wage Information poster as well as various other posters in their place of work visible to all employees.

Pursuant to the CORPORATE TRANSPARENCY ACT (CTA) certain LLCs & Corporations are required to disclose information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This law became effective January 1, 2024.

Any business created prior to 2024 has until January 1, 2025, to file its initial beneficial ownership information (BOI) report. Any business started in 2024 has 90 calendar days from the date of formation to file a BOI report. Any business required to report, formed on or after January 1, 2025, must file a BOI report within 30 calendar days of formation.

The information requested for beneficial owners (25% or more) are:

- Legal Name of Business

- Business EIN

- Individual’s Full Name

- Date of Birth

- Home Address

- Copy of Driver’s License or Passport

Failure to file can lead to fines of up to $500 per day up to $10,000.

Additional information can be found at www.fincen.gov/boi

If you require assistance with filing the Beneficial Owners Information Report, please contact us.

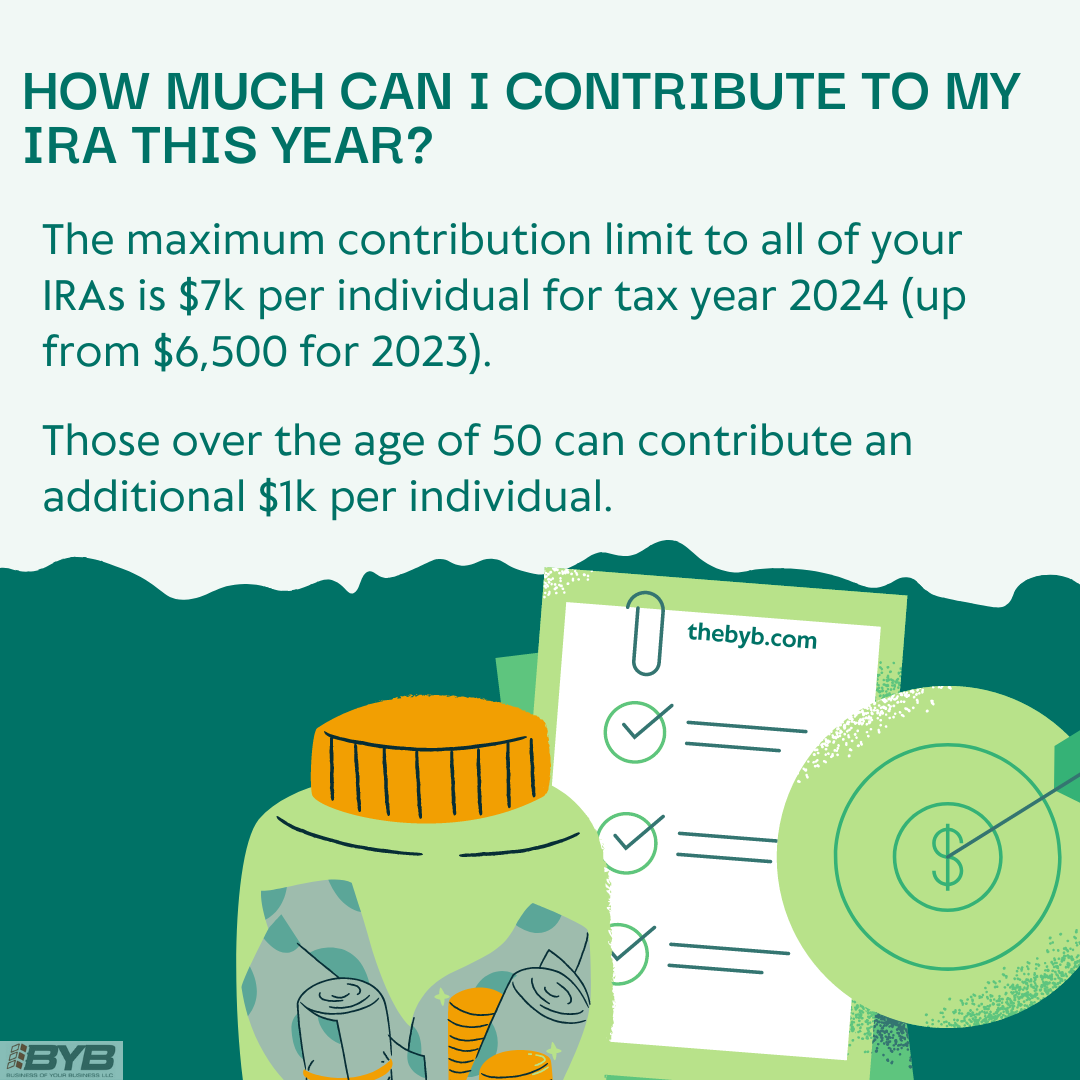

The IRS has announced the contribution limit for employees who participate in a 401K, 403B and most 457 plans has increased to $23,000 for the tax year 2024 (up from $22,500 for 2023).

The IRS has announced the contribution limit for employees who participate in a 401K, 403B and most 457 plans has increased to $23,000 for the tax year 2024 (up from $22,500 for 2023).

The catch-up contribution limit for employees aged 50 and over who participate in these plans will remain at $7,500 for 2024.

© 2025 Business of Your Business

Theme by Anders Noren — Up ↑